Best WooCommerce Payment Gateways in 2025

Starting an online store is an exciting journey, but one of the most critical steps is setting up a reliable payment gateway.

Payment gateways in WooCommerce connects your customers payment to the seller pocket – ensuring secure and hassle-free transactions every time.

To make things easier for you, we’ve handpicked the 7 best WooCommerce payment gateways. In this article, you’ll discover their features, pros, and cons, so you can confidently choose the perfect one for your store.

How to choose the best WooCommerce Payment Gateway

When setting up an online store with WooCommerce, choosing the right payment gateway is important for your business’s success. Here’s what you need to look for before choosing a WooCommerce gateway-

1. Understand Your Target Market

In an online store, understanding your target market is fundamental because your customer’s preferred payment methods can significantly impact your sales.

For example, while credit cards are widely used in the United States, many European customers prefer bank transfers, and Asian markets often use digital wallets like WeChat, pay, or Alipay. You have to conduct market research or analyze your existing customer base to identify which payment methods they are most comfortably using.

2. Compare Transaction Fees and Other Charges

When you are starting your business you have to compare the transaction fees and other fees. These transaction fees and other charges can affect your bottom line directly. Typically, payment gateway charges in three ways-

- A fixed fee per transaction,

- A percentage of each sale,

- Monthly or annual subscription fees.

For example, a gateway may charge 2.9%+ $0.30 per transaction plus a monthly fee of $30. When comparing options, calculate the total costs using your expected sales volume. If you process many small transactions, a gateway with a lower fixed fee be more economical.

Also, if you handle fewer but larger transactions, focus on gateways with lower percentage fees.

3. Recurring Payments

Recurring payment capability becomes essential if you offer subscription-based products or services. Not all payment gateways support automated recurring billing and may handle it differently. Look for features like the ability to change subscription amounts, pause subscriptions, and handle failed payments efficiently.

Beside this, make sure the payment gateway has easy-to-use tools to track subscription trends and manage billing cycles smoothly. A good recurring payment system helps keep customers happy and makes it easier to predict your business’s income.

4. Choose Your Ecommerce Platform

Now that you’ve conducted market research and confirmed the sustainability of your product, it’s time to select the right platform to host your online business. The right platform is essential for setting up a professional, reliable, and user-friendly store.

Start by selecting a popular hosting service that ensures speed, security, and scalability. Combine this with WordPress, a flexible and highly customizable website builder. To streamline the selling process, integrate an easy-to-use e-commerce platform like EasyCommerce. These platforms simplify inventory management, payment processing, and even cart abandonment recovery.

Once your platform is set up, you’ll have the foundation you need to create a seamless shopping experience for your customers and grow your business.

5. Availability in Your Target Region

Your target business region plays an important role in choosing the right payment gateways. Regional availability or unavailability can affect both your ability to accept payments and your customers’ experience. Some payment gateways operate only in specific countries or regions whereas international payment cateways works beyond the border as well.

When expanding internationally, ensure your chosen gateway supports multiple currencies and can process payments from your target countries. Also, consider whether the gateway offers local payment methods that are popular in those regions. A payment gateway that works perfectly in North America may not be suitable for expanding into the European or Asian Market.

6. Make Sure the Payment Gateway is Secure

Security is top priority in ecommerce payment gateways, as it protects both your business and customers money. Thats why look for gateways with advanced security compliance such as PCI DSS. Also ensure that your choosen gateway offers secure credit card data handing.

Ensure robust fraud prevention features like Address Verification Service (AVS), Card Verification Value (CVV) checks, and 3D Secure authentication for enhanced security. Some gateways even offer machine-learning-based fraud detection. Consider testing payment gateways with similar capabilities instead of struggling with the limitations of WooCommerce Payments.

7 Best WooCommerce Payment Gateways: Comparison

Here’s a comparison table summarizing the information:

| Payment Gateway | Transaction Fee | Supported Currencies and Regions | Key Features |

| Stripe | 2.90% + $0.30 per transaction | 135+ currencies, 46 countries | Customizable APIs, recurring billing, fraud prevention with machine learning, global payments |

| PayPal | 2.99% + fixed fee per transaction | 25 currencies, 200+ countries | Trusted brand, Express Checkout, buyer/seller protection, professional invoicing |

| Square | 2.90% + $0.30 per transaction | 6 currencies, 8 countries | POS system, hardware options, inventory tracking, employee management tools |

| Amazon Pay | Domestic 2.9%+$0.30 per transaction | 80+ currencies, 18 countries | Integration with Amazon accounts, Alexa payments, advanced fraud detection, subscription billing |

| Apple Pay | Free for domestic transactions | 80+ currencies, 83 countries | Apple device support, tokenization for security, biometric authentication |

| Alipay | 3% per transaction | 27 currencies, 110+ countries | QR code payments, multi-currency support, mobile wallet with additional financial services |

| WooCommerce Payments | 2.90% + $0.30 per local transaction | 135+ currencies, 38 countries | Built-in integration, multi-payment methods, recurring payments management, dashboard reporting |

Best WooCommerce Payment Gateways Overview

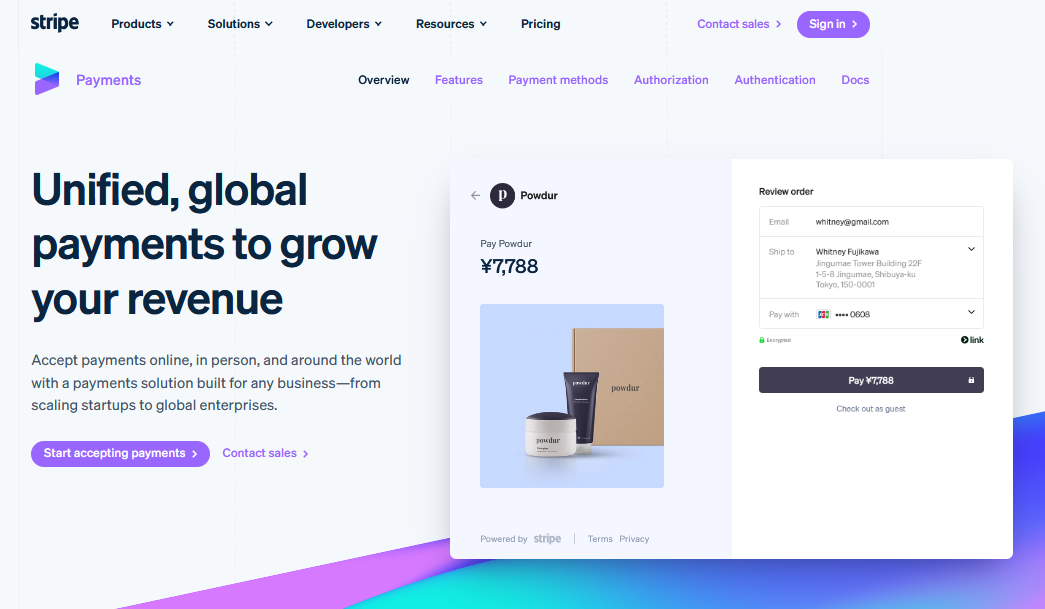

1. Stripe

Transaction fee: 2.90% + $0.30 per card or digital wallet transaction.

Supported Currencies and Regions: 135+ currencies and 46 countries.

WooCommerce Stripe payment extension is one of the most popular platforms out there. . This popular gateway is easily integratable and lets you accept transactions from major credit-debit cards as well as local payment methods.

Stripe is widely recognized for its rapid growth, developer-friendly tools, and scalability, making it an excellent choice for managing WooCommerce subscriptions.

With powerful APIs and extensive documentation, Stripe allows businesses to customize their payment processes to fit specific needs. This flexibility is particularly beneficial for WooCommerce stores requiring tailored integrations.

Stripe Key Features

- Allow businesses to customize payment solutions to their specific needs.

- Supports recurring billing and subscription services.

- Utilizes machine learning to prevent fraudulent transactions.

- Enable businesses to accept payments from customers worldwide.

Pros

- Developer-friendly and customizable APIs.

- Suitable for startups and large enterprises.

- Clear and straightforward transaction fees without hidden costs.

Cons

- Some users report sudden account holds or closures without prior notice.

- Experienced delays in support response time.

- Require technical expertise to fully utilize its features.

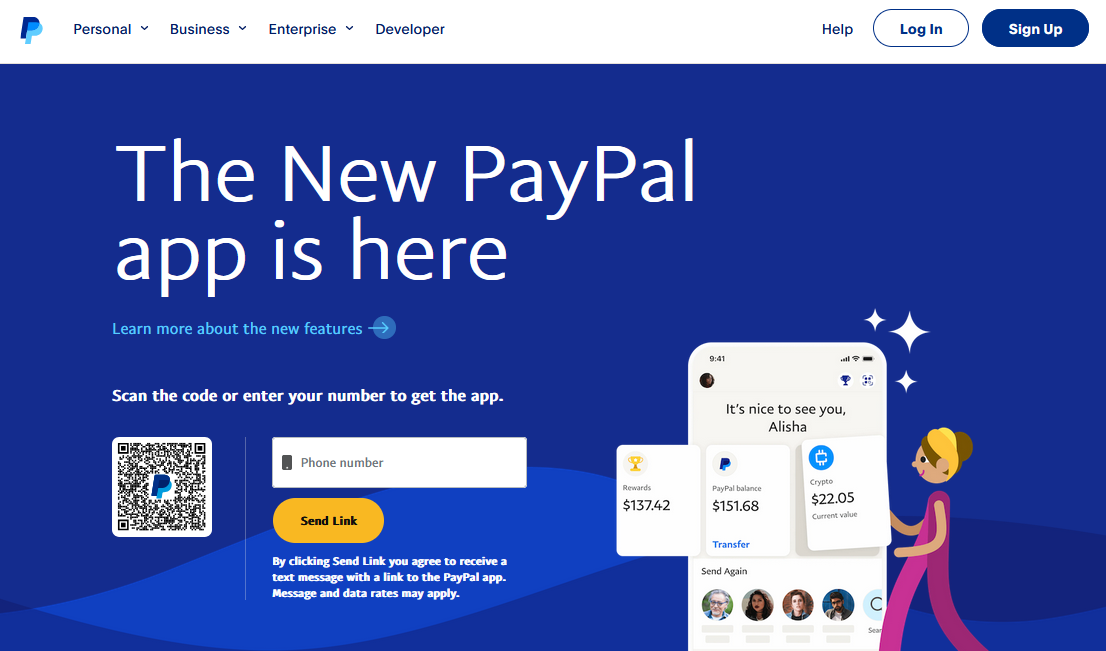

2. PayPal

Transaction fee: 2.99% + fixed fee per card transaction.

Supported Currencies and Regions: 25 currencies and 200+ countries.

PayPal is a trusted and widely recognized payment gateway that works effortlessly with WooCommerce, allowing merchants to accept payments from customers around the globe.

Supporting multiple currencies and a variety of payment methods—including credit cards, debit cards, PayPal accounts, and alternative payment options—PayPal is designed to meet the needs of a diverse audience.

Its Express Checkout feature simplifies the payment process, helping to reduce cart abandonment by allowing faster checkouts without requiring customers to re-enter their information.

PayPal Key Features

- Widely recognized and trusted by consumers globally.

- Offers dispute resolution and protection policies for both buyers and sellers.

- Allows customers to purchase with a single touch.

- Enables businesses to send professional invoices and receive payments.

Pros

- Access to a global customer base.

- Easy setup and navigation.

- Supports various payment methods.

Cons

- Transaction fees can be higher compared to other gateway.

- Reports of account freeze, especially for new or high-risk accounts.

- Additional fees may apply for currency conversion.

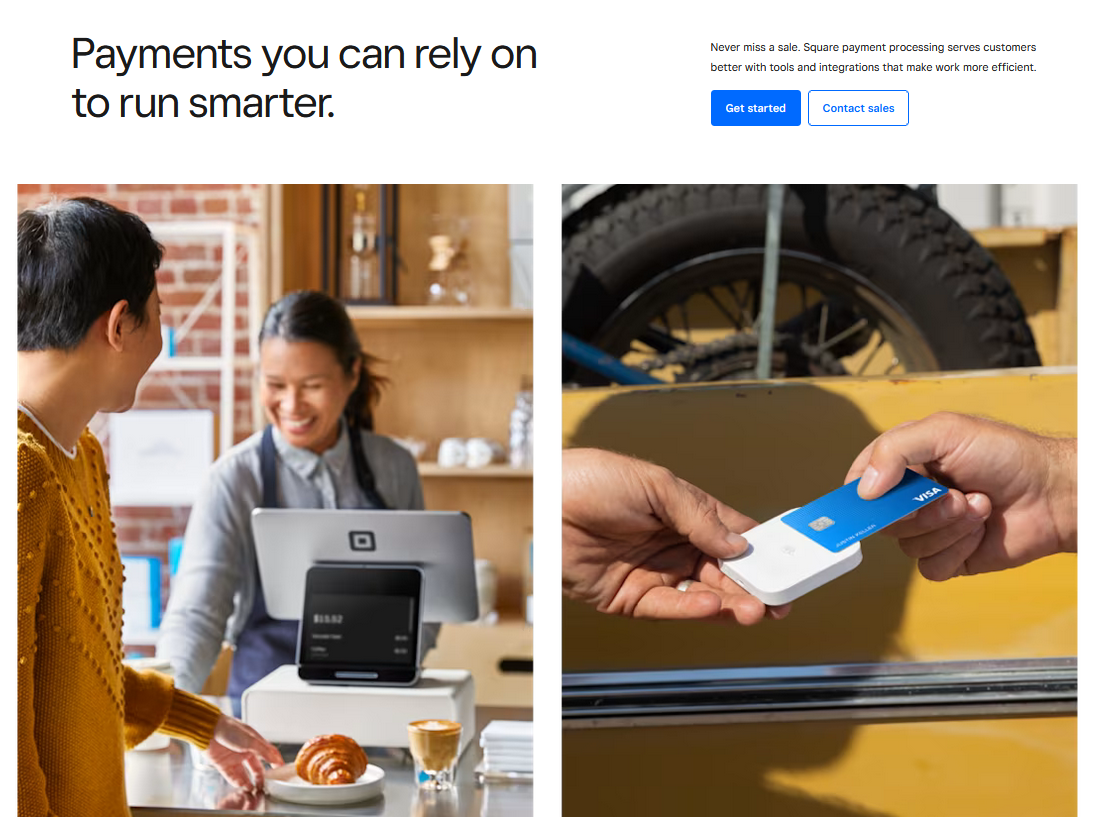

3. Square

Transaction fee: 2.90% + $0.30 per transaction for Free and Plus users.

Supported Currencies and Regions: 6 currencies and 8 countries.

Square is a versatile payment processing platform tailored to meet the needs of modern businesses. It integrates smoothly with WooCommerce, allowing merchants to accept payments both online and in-person for a consistent and convenient experience.

One of its standout features is support for digital wallets, which enhances the checkout process for customers. Square also enables businesses to offer digital gift cards, a valuable tool for boosting sales and encouraging customer loyalty.

With a transparent pricing model- no hidden fees or long-term commitments, Square appeals to businesses seeking a straightforward and dependable payment solution.

Square Key Features

- Provides Point of Sale (PoS) system suitable for various business types.

- Offers hardware like card readers and terminals for in-person transactions.

- Includes tools to track and manage inventory.

- Features to manage employee permissions, time-tracking, and payroll integration.

Pros

- Supports Apple Pay and Google Pay.

- No monthly or set-up fees.

- Provides quick access to funds.

Cons

- Services are primarily available in selected countries.

- Higher fees for certain transactions.

- Some users report sudden account holds or fund reserves.

4. Amazon Pay

Transaction fee: Domestic 2.9%+$0.30 and Cross-border 3.9%+$0.30.

Supported Currencies and Regions: 80+ currencies and 18 countries.

Amazon Pay, Amazon’s own payment gateway, enables WooCommerce stores to offer customers a familiar and trusted way to complete their purchases.

With Amazon Pay integration, customers can enjoy a seamless checkout experience by using their existing Amazon accounts. The dedicated WooCommerce plugin ensures the integration process is simple and efficient.

Amazon Pay supports multi-currency transactions and includes advanced fraud detection tools, leveraging Amazon’s secure payment infrastructure to safeguard both merchants and customers during transactions.

Amazon Pay Key Features

- Allows customers to use Amazon accounts for payments.

- Supports payments through Alexa-enabled devices.

- Facilitates subscription-based billing and recurring payments.

- Provide advanced Amazon’s fraud detection capabilities.

Pros

- Association with Amazon can increase customer trust.

- Reduces cart abandonment with familiar and quick payment.

- Easy setup and management.

Cons

- Checkout experience has limited customization options.

- Must comply with Amazon’s merchant policies.

- Not available in all countries.

5. Apple Pay

Transaction fee: Free for domestic transactions

Supported Currencies and Regions: 80+ currencies and 83 countries.

Apple Pay is a payment service designed for users of Apple’s latest products. Initially relying on the iPhone’s NFC (near-field communication) technology, it has since expanded to offer a variety of payment options.

Customers can use Apple Pay for purchases in both online stores and physical shops, as well as for in-app transactions in platforms like Airbnb, Starbucks, and Kickstarter.

Although it was initially launched in the United States, Apple Pay is now available in many countries.

Apple Pay Key Features

- Enables features via Apple devices.

- Supports in-app and website payments.

- Utilizes tokenization to replace card details with codes.

- Provide authentication with biometric verification.

Pros

- Offers speed and advanced security measures.

- Works with numerous payment terminals and integrates with many apps.

- No need to carry physical cards.

Cons

- Only works with Apple devices.

- Merchants still incur credit card processing fees.

- Some regions and merchants do not yet support it.

6. Alipay

Transaction fee: 3% per card transaction.

Supported Currencies and Regions: 27 currencies and 110+ countries.

Alipay, managed by Ant Group, is among the world’s largest mobile and online payment platforms, serving over 1.3 billion users, primarily in China.

For WooCommerce merchants aiming to access the vast Chinese market, integrating Alipay as a payment gateway provides a significant advantage.

The platform supports cross-border payments, allowing international merchants to accept payments from Chinese customers in their local currency, with settlements made in the merchant’s preferred currency. This simplifies international transactions and eliminates the hassle of currency conversions.

Alipay Key Features

- Offer quick payments through QR codes.

- Support multiple currencies.

- Provides full-fledged mobile wallet with services like bill payments and fund transfers.

Pros

- Popular choice for Chinese customers and global merchants focusing on Chinese buyers.

- Provide quick access to funds, often faster than traditional methods.

- Goes beyond payment with wallet functionalities and financial services.

Cons

- Require additional steps integration for non-Chinese.

- Strong focus on Chinese customers may limit appeal in other markets.

7. WooCommerce Payments

Transaction fee: 2.90%+ $0.30 Per local transaction for US-issued cards

Supported Currencies and Regions: 135+ currencies and 38 countries

WooPayments is a payment gateway designed exclusively for WooCommerce, providing seamless integration without relying on third-party solutions. With WooPayments, store owners can manage all aspects of their transactions directly from the WordPress dashboard, offering a convenient, all-in-one solution for WooCommerce users.

The gateway supports various payment methods, including major credit cards, Apple Pay, and Google Pay, ensuring a smooth and user-friendly checkout process for customers. Additionally, WooPayments simplifies tasks like handling refunds, managing disputes, and processing multi-currency transactions, making it a robust and efficient choice for WooCommerce stores.

WooCommerce Payments Key Features

- Built-in WooCommerce integration.

- Provide multiple payment methods.

- Provides tools for managing recurring payments.

- Offers in-dashboard reporting to track sales and payment trends.

Pros

- Best for WooCommerce site ensuring smooth integration.

- Simple transaction with no hidden charge.

- Accepts payments in multiple currencies.

Cons

- Not available in all countries.

- Dependent on WordPress.

- Cross-border fees can be higher.

Final Words

Your business depends on customers payments. When the business is online, having the right payment gateway by your side can help your business not just to run smoothly but to scale everyday. Its also important for your WooCommerce store as it ensures customers gets a smooth, secure, and friendly checkout experience. Each gateway reviewed in this article offers unique features and benefits tailored to various business needs.

You have to keep this in mind that, a well-integrated and user-friendly gateway can significantly improve your store’s credibility and conversion rates. So before taking your action analyze and test it properly and then implement on your website.

Frequently Asked Questions (FAQs)

Q. Does WooCommerce have its own payment gateway?

Yes, WooCommerce does have its own payment gateway called WooCommerce Payments. This gateway is designed to integrate seamlessly with WooCommerce, providing a smooth and efficient payment processing experience directly within your WooCommerce dashboard.

Q. Which payment gateways are best for WooCommerce?

The top WooCommerce payment gateways include PayPal, Stripe, and Square. These platforms are renowned for their dependability, seamless integration, and ability to support a wide range of payment methods and international customers.

Q. Can I integrate a payment gateway with a website?

Absolutely! You can integrate a payment gateway with your website to securely accept digital payments from customers. Here’s a more user-friendly version of the steps:

- Step 1: Choose the payment gateway that best suits your needs.

- Step 2: Sign up and create a merchant account with the chosen payment gateway.

- Step 3: Get the necessary API credentials from the payment gateway provider.

- Step 4: Set up your website to work with the payment gateway.

- Step 5: Test the integration in a sandbox environment to ensure everything works smoothly.

- Step 6: Once testing is successful, switch to live mode to start accepting real payments.

- Step 7: Keep an eye on your integration to ensure it continues to work correctly and securely.

Subscribe to Our Newsletter

Get the latest WordPress tutorials, trends, and resources right in your inbox. No Spamming, Unsubscribe Anytime.

Thank you for subscribing to our newsletter!

Table of Content

- How to choose the best WooCommerce Payment Gateway

- 1. Understand Your Target Market

- 2. Compare Transaction Fees and Other Charges

- 3. Recurring Payments

- 4. Choose Your Ecommerce Platform

- 5. Availability in Your Target Region

- 6. Make Sure the Payment Gateway is Secure

- 7 Best WooCommerce Payment Gateways: Comparison

- Best WooCommerce Payment Gateways Overview

- 1. Stripe

- Stripe Key Features

- Pros

- 2. PayPal

- PayPal Key Features

- Pros

- Cons

- 3. Square

- Square Key Features

- Cons

- 4. Amazon Pay

- Amazon Pay Key Features

- Pros

- 5. Apple Pay

- Apple Pay Key Features

- Pros

- Cons

- 6. Alipay

- Alipay Key Features

- Pros

- Cons

- 7. WooCommerce Payments

- WooCommerce Payments Key Features

- Pros

- Cons

- Final Words

- Frequently Asked Questions (FAQs)

- Q. Does WooCommerce have its own payment gateway?

- Q. Which payment gateways are best for WooCommerce?

- Q. Can I integrate a payment gateway with a website?